how much does cash app charge to deposit

Each location may charge up to 495 for each cash deposit but you wont be charged a fee from Varo Bank. Pay As You Go Visa Debit Card -.

Can You Send Money From Paypal To Cash App Android Authority

Transactions must be a minimum of 5 and cannot exceed 500 per deposit.

. But if you set up a direct deposit and receive more than 300 per month in your Cash App balance then youll be reimbursed for three ATM withdrawals over a 31 day period. For information on cashing a check using the Ingo Money App cashing and loading a check at Walmart or cashing and depositing a check at an FSC location please refer to those FAQs. Money transfer via Credit Card.

Is there a limit on how much cash I can deposit to my GO2bank account. Cash App has a transfer limit for how much you can send and how much you can receive. No fee if you choose a standard money transfer method.

According to the IRS 152 million taxpayers are expected to. Green Dot Visa Debit Card - Retail deposit fee of up to 495 may apply. Cash app charges are nil when transferring to bank accounts and debit cards.

Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card. There are no fees for using the mobile check deposit feature with Cash App though there are some limits to how much and how often you can deposit including a 3500 per check limit and a 5 mobile check deposit limit per month. It charges the sender a 3 fee to send a payment using a credit card and 15 for an instant deposit to a bank account.

Instant Deposits are subject to a 05 -175 fee with a minimum fee of 025 and arrive instantly to your debit card. The Cash app doesnt charge a fee to send request or receive personal payments from a debit card or a bank account or for a standard deposit. You can deposit up to 1000 per day with a maximum of 5000 per month.

You can do so for free on Android and iOS devices. The deadline to send in your 2021 tax return is rapidly approachingApril 18but millions of Americans have yet to file. Instant deposits cost 15 and a minimum deposit fee of 025.

It costs 3 of the total amount transferred. Cash App ATM withdrawals would cost you 2 fee unless you make 300 deposit in your account every month. 11 rows One wat to add cash to your Cash App balance is to do a direct deposit.

1 Install and Open Cash App. Once I complete. There is no fee to make mobile check deposits to your account using the Green Dot app.

Just find a location near you and ask the cashier to add cash to your activated Varo Bank Visa Debit card. How much does the Cash app charge for instant deposits. You can then either mail the deposit to your online bank or use the banks mobile app to make a.

With Paper Money deposits you can deposit up to 1000 per rolling 7 days and 4000 per rolling 30 days. How do I deposit cash to my account using the GO2bank app. You can deposit cash to your Chime Checking Account at over 75000 other retail locations like Walmart CVS and 7-Eleven.

Cash app for instant cash deposite charge 15 of the amount being transferred. Limits and fees are listed below and may change at any point. For credit cards there.

How to Link Chase Bank to Cash App Step-By-Step If you are wanting to use Cash App with your Chase Bank account to send money and more this is how you can easily do it. Please see the steps. Cash app charges on the bank account.

If you request to transfer money to a bank account the. How much does it cost to deposit cash to my account using the app at a retailer. The 7-day and 30-day limits are based on a rolling time frame.

Cash App also charges a 15 percent fee if you request an Instant Transfer of funds from your Cash App account to your linked debit card. If you are sending money via a credit card linked to your Cash App a 3 fee will be added to the total. For business payments the customer is charged 275.

You can make free cash deposits at any Walgreens location. For more information click to view the Account Agreement. Standard deposits are free and arrive within 1-3 business days.

First you need to install Cash App on your preferred device. Once you have Cash App. The retailer may have a service fee of 495 or less.

Moreover the limit for the cash out is set at 1000 per dayand 310 per transaction in one day. Cash app charges 15 minimum 025 for each instant deposit. These 3 products allow you to deposit cash using the app.

How do I know that the deposit went through on my account. Chime does not accept deposits of any kind from an ATM. Even better is that for every subsequent 300 deposited in your account youll be reimbursed for another 31 days.

Users are allowed to send up to 250 within any seven-day period and receive up to 1000 within any 30-day period according to the website. Cash App Fee At a Glance. It charges a fee of 2 to 3 typically.

Deposit cash using the app How much does it cost to deposit cash to my account using the app at a retailer. So if you are transferring 1000 dollars you will need to pay them 15 dollars extra. How much cash can be deposited to my account using the app.

Cash Back Visa Debit Card - Free. There you can purchase money orders for up to 1000 and at fees ranging from 125 to 175.

Cash App Your Bank Declined This Payment

Cash App Down Current Problems And Outages Downdetector

How To Send Money On Cash App Without Debit Card Techyloud

What Does Pending Mean On Cash App Learn All About The Cash App Pending Status Here

/A2-DeleteCashAppAccount-annotated-5d48188372ff4dcb945d9c30f361bc4b.jpg)

How To Delete A Cash App Account

Send And Receive Stock Or Bitcoin

Review Of Cash App Direct Deposit Cash App How To Get Money Cash Card

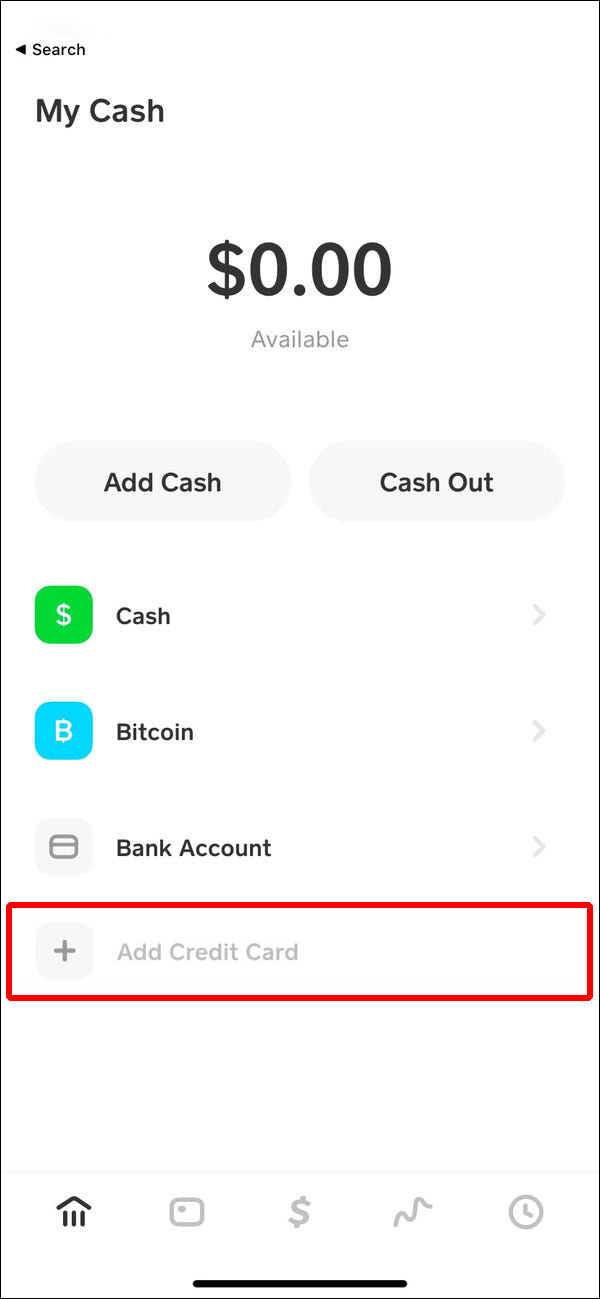

How To Add A Debit Card To The Cash App

Cash App Card Features And How To Get One Gobankingrates

Cash App Free Money Tutorial I Make Up To 500 Everyday With This Cash App Money Tutorial Youtube

Cash App Down Current Problems And Outages Downdetector

How Much Does Cash App Charge To Cash Out A Complete Guide

Cash App Vs Venmo How They Compare Gobankingrates

What Is The Cash App And How Do I Use It

What Does Cash Out Mean On Cash App Here S An Explanation And Simple Cash Out Method

/cash-app-logo-180e2a0d248a4357bd9642f328a643a3.png)